How to Copy Trade Profitable Whales on Polymarket

There is a reason why institutional traders rarely share their positions publicly. In prediction markets like Polymarket, information asymmetry is the edge. Some traders consistently outperform because they have better research pipelines, faster data feeds, or simply more experience reading market dynamics. The rest of us are left reacting to price moves after the fact, wondering what we missed.

But here is the thing: blockchain transparency cuts both ways. Every trade on Polymarket is recorded on-chain. If you can identify the wallets that consistently profit, you can observe their behavior in real time. This is the foundation of copy trading.

This guide walks you through the entire process. We will cover how to scout profitable whales using the PolyAlertHub Leaderboard, how to analyze their signals manually without blindly following every move, and for developers, how to build an automated copy trading system using the PolyAlertHub API.

What You Will Learn

- How to identify "directional whales" vs. market makers on the Top Traders page

- Why whale consensus matters more than individual trades

- How to use API endpoints to automate your tracking

- Testing strategies with paper trading before risking real capital

- A working Python script for whale monitoring

The "Smart Money" Problem

Prediction markets attract a specific type of participant: people who believe they have an informational edge. Some of these traders are professionals who spend hours researching outcomes. Others have access to information networks that retail traders do not. A select few might even have insider knowledge, though this is a controversial topic in the prediction market space.

The problem for most retail traders is timing. By the time news breaks publicly, the smart money has already moved. You see the price jump from 35 cents to 52 cents and wonder what happened. The answer is usually that a few large players positioned themselves before the information became widely known.

Copy trading flips this dynamic. Instead of trying to out-research professional traders, you let them do the work. When their wallets move, you move. When multiple smart wallets converge on the same outcome, you have a high-confidence signal that something is happening.

Important Caveat: Copy trading is not a guaranteed strategy. Whales lose money too. The goal is to use their activity as one input in your decision-making process, not as a substitute for thinking.

Step 1: Scouting the Right Whales

Not all large traders are worth following. This is the first mistake people make when attempting to copy trade on Polymarket. They see a wallet with $2 million in trading volume and assume that trader must know what they are doing. Volume alone tells you nothing about profitability.

Market Makers vs. Directional Whales

There are two broad categories of large traders on Polymarket:

Market Makers provide liquidity by placing limit orders on both sides of the book. They profit from the spread, not from predicting outcomes. A market maker might have enormous volume but zero directional conviction. Following their trades is meaningless because they are not expressing a view on the outcome.

Directional Whales take large positions based on their beliefs about what will happen. They might buy $100,000 worth of "Yes" shares because they genuinely believe the probability is mispriced. These are the traders you want to identify.

Using the Top Traders Page

The PolyAlertHub Top Traders Page is your starting point for whale scouting. Here is how to filter for traders worth following:

-

Sort by PnL, not Volume. A trader with $500,000 in volume and $200,000 in losses is not worth copying. A trader with $50,000 in volume and $15,000 in profit might be.

-

Check Win Rate with Context. A 95% win rate sounds great until you realize the trader only bets on outcomes priced at 95 cents. They are picking up pennies. Look for traders with strong win rates on outcomes that were not near certainty.

-

Examine Market Specialization. Some whales only trade political markets. Others focus on crypto. If a politics specialist suddenly takes a large position in a sports market, that trade carries less weight.

API Equivalent for Developers

If you are building automated systems, you can fetch leaderboard data programmatically using the /elite/getTopTraders endpoint.

import requests

API_KEY = "poly_your_api_key_here"

BASE_URL = "https://api.polyalerthub.com"

HEADERS = {"Authorization": f"Bearer {API_KEY}"}

def get_top_traders_by_pnl():

response = requests.get(

f"{BASE_URL}/elite/getTopTraders",

headers=HEADERS,

)

return response.json()

top_traders = get_top_traders_by_pnl()

for trader in top_traders:

print(f"Wallet: {trader['userId']} | PnL: ${trader['netRealizedPnL']:,.2f}")

This allows you to maintain an updated list of high-performing wallets to monitor.

Step 2: Analyzing Consensus Signals

Here is where most copy traders go wrong: they follow a whale on every trade. This is a losing strategy for several reasons.

First, whales hedge. A trader might buy $50,000 of "Yes" shares as insurance against a larger position elsewhere. Their bet does not reflect their actual prediction; it reflects their risk management.

Second, whales experiment. Even profitable traders take speculative positions in markets they are less confident about. Not every trade from a smart wallet is a high-conviction play.

Third, whales get it wrong. Nobody has a 100% hit rate. If you blindly copy every trade, you copy the losses too.

The Power of Convergence

The solution is to look for whale consensus. Instead of following one trader, you wait for multiple independent smart wallets to take the same position within a short time window.

Think about it this way: if one whale buys "Yes" on an outcome, that is interesting but not definitive. If three unrelated top-tier traders all buy "Yes" within a two-hour window, something is likely happening. The probability that three different smart money players independently reached the same conclusion by chance is low.

This convergence signal is far more reliable than any single trade.

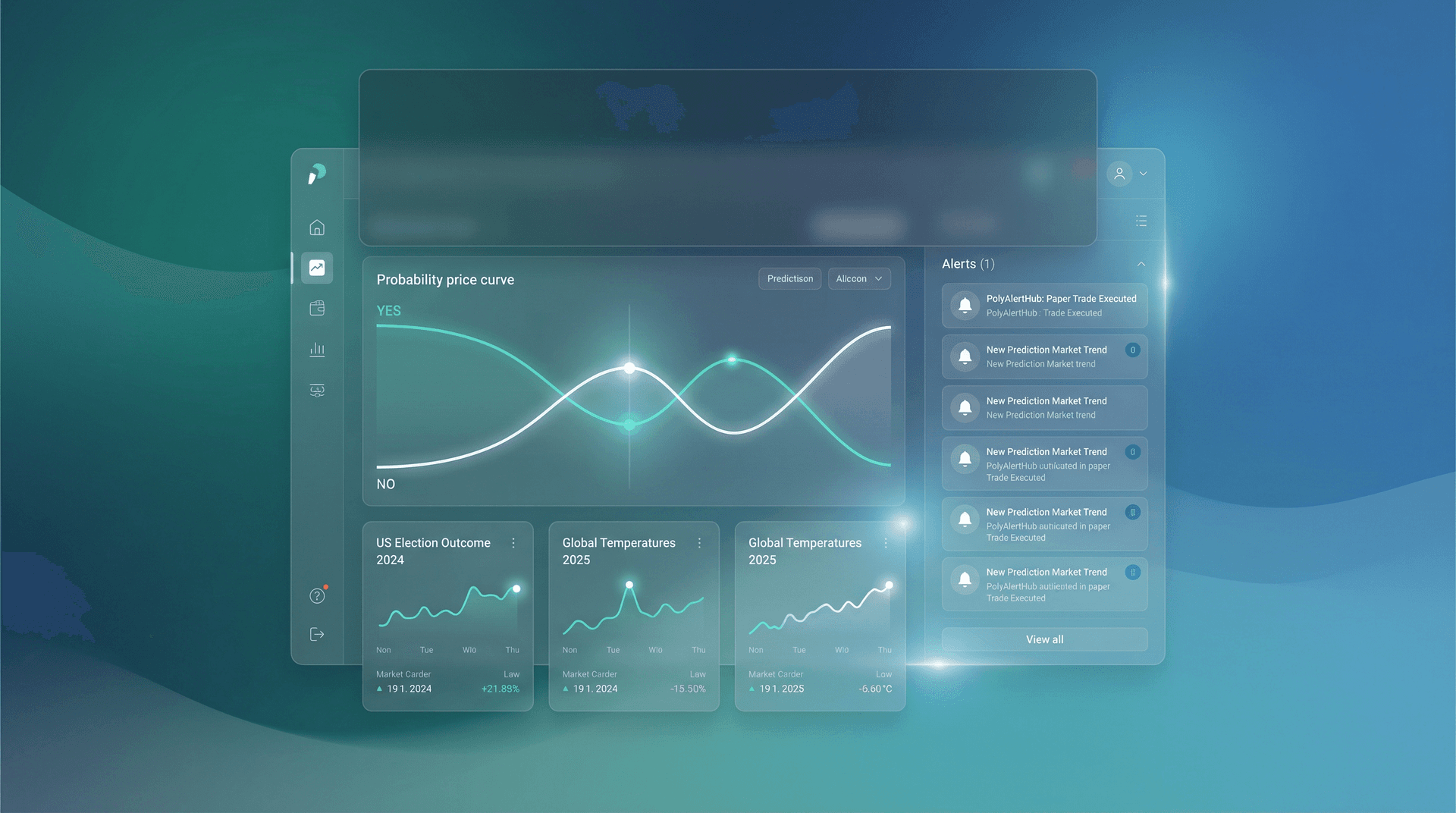

Using PolyAlertHub for Consensus Tracking

The Whale Convergence section of PolyAlertHub surfaces these consensus moments automatically. Instead of manually cross-referencing multiple wallets, you can see at a glance when smart money is aligning.

For programmatic access, two endpoints are particularly useful:

/elite/getWhaleConsensusSignals returns markets where multiple tracked whales have taken the same directional position recently.

/elite/getWhaleConvergence provides a real-time feed of convergence events, including the number of whales involved, the direction, and the time window.

def get_whale_consensus():

response = requests.get(

f"{BASE_URL}/elite/getWhaleConsensusSignals",

headers=HEADERS

)

signals = response.json()

for signal in signals:

if signal['whaleCount'] >= 3:

print(f"High Consensus: {signal['eventSlug']}")

print(f" Direction: {signal['outcome']}")

print(f" Whales Aligned: {signal['whaleCount']}")

print(f" Total Value: ${signal['totalSize'] * signal['averagePrice']:,.2f}")

These endpoints do the heavy lifting for you. Instead of manually monitoring dozens of wallets, you receive pre-computed signals when the smart money agrees.

Step 3: Automating the Strategy

Manual copy trading works, but it has a fundamental limitation: speed. Whales move fast. By the time you receive an email alert, open the dashboard, analyze the trade, and decide to act, the price might have already shifted against you.

This is why serious copy traders automate their workflows. Automation lets you detect whale activity in real time and execute decisions in seconds rather than minutes.

The Automated Workflow

Here is a typical architecture for an automated copy trading system:

-

Poll for Activity: Use GET /elite/getWhaleTrades on a regular interval (every 30 to 60 seconds) to scan for new transactions above your threshold.

-

Filter by Wallet List: Check if the wallet address matches one of your scouted whales from Step 1. Ignore trades from unknown wallets.

-

Check for Consensus: Before acting on any single trade, query the convergence endpoints to see if other whales are aligned.

-

Verify Liquidity: Use GET /elite/getMarketInsights to check the order book liquidity. If liquidity is thin, your entry will suffer from slippage.

-

Execute or Paper Trade: Place your order via Polymarket directly, or test the strategy first using paper trading.

Sample Monitoring Script

The following Python script demonstrates the core logic:

import requests

import time

# Configuration

API_KEY = "poly_your_api_key_here"

BASE_URL = "https://api.polyalerthub.com"

HEADERS = {"Authorization": f"Bearer {API_KEY}"}

# List of high-performing wallets to track

SCOUTED_WHALES = [

"0x1234...abcd",

"0x5678...efgh",

"0x9abc...ijkl"

]

MIN_TRADE_SIZE = 10000 # Only consider trades above $10k

def check_whale_moves():

response = requests.get(

f"{BASE_URL}/elite/getWhaleTrades",

headers=HEADERS,

)

trades = response.json()

for trade in trades:

# Filter for our scouted whales

if trade['trader_address'] not in SCOUTED_WHALES:

continue

if trade['size'] < MIN_TRADE_SIZE:

continue

# Filter for high-conviction buys

if trade['size'] >= 50000 and trade['side'] == 'BUY':

print(f"SIGNAL: {trade['proxyWallet'][:10]}... bought ${trade['size'] * trade['price']:,.0f}")

print(f" Market: {trade['title']}")

print(f" Outcome: {trade['outcome']}")

# Check if other whales agree

check_consensus(trade['eventSlug'], trade['outcome'])

def check_consensus(eventSlug, outcome):

response = requests.get(

f"{BASE_URL}/elite/getWhaleConvergence",

headers=HEADERS,

params={"eventSlug": eventSlug}

)

convergence = response.json()

if convergence.get('whaleCount', 0) >= 3:

print(f" CONSENSUS CONFIRMED: {convergence['whaleCount']} whales aligned on {outcome}")

# Trigger your trading logic here

else:

print(f" No consensus yet. Single whale trade.")

# Run continuously

while True:

check_whale_moves()

time.sleep(60) # Poll every 60 seconds

This is a starting point. A production system would include error handling, rate limit management, position sizing logic, and integration with your execution layer.

Step 4: Testing Risk-Free with Paper Trading

Before deploying any automated strategy with real capital, you need to validate that it actually works. This is where paper trading becomes essential.

PolyAlertHub offers a full paper trading API that mirrors the real Polymarket experience. You can place simulated orders, track performance, and iterate on your strategy without risking a single dollar.

Creating Paper Trade Orders

Use the POST /elite/paper-trade/createOrder endpoint to execute simulated trades:

def place_paper_trade(tokenId, side, size):

payload = {

"tokenId": tokenId,

"side": "BUY",

"size": 10,

"executionType": "MARKET"

}

response = requests.post(

f"{BASE_URL}/elite/paper-trade/createOrder",

headers=HEADERS,

json=payload

)

if response.status_code == 200:

order = response.json()

print(f"Paper trade placed: {order['status']}")

else:

print(f"Error: {response.text}")

After running your paper trading strategy for a few weeks, use GET /elite/paper-trade/account/stats to evaluate results:

def get_paper_trading_stats():

response = requests.get(

f"{BASE_URL}/elite/paper-trade/account/stats",

headers=HEADERS

)

stats = response.json()

print(f"Total Trades: {stats['totalTrades']}")

print(f"Win Rate: {stats['winRate']}%")

print(f"Net PnL: ${stats['totalPnl']:,.2f}")

The value proposition is straightforward: prove your bot works on simulated data before you risk real capital. Many traders skip this step and pay the price.

Step 5: Managing Risk and Avoiding Pitfalls

Copy trading is not foolproof. Here are the risks you need to manage:

Slippage

When you copy a large whale trade, you are often buying into a market that just moved. If the whale bought at 42 cents and the price is now 47 cents by the time you act, you have already lost a significant portion of the potential edge.

Mitigation: Use limit orders rather than market orders. Accept that you will sometimes miss trades rather than chase every signal.

Whale Hedging

As mentioned earlier, not every whale trade reflects their genuine prediction. They might be hedging exposure elsewhere. A hedge looks identical to a directional bet on the order book.

Mitigation: Focus on consensus signals. A single whale hedging is common. Three whales "hedging" in the same direction is unlikely.

New Wallet Detection

Sophisticated traders sometimes create fresh wallets to avoid detection. These wallets appear suddenly with large positions and no history.

The /elite/getInsiderAnalytics endpoint helps identify suspicious new wallets that might represent insider activity or wallet rotation by known players.

Rate Limits

The PolyAlertHub API enforces rate limits to ensure fair access. Pay attention to the X-RateLimit headers in API responses. Standard tier users have lower limits than Heavy tier subscribers.

If you are polling frequently for automated trading, you may need to upgrade your plan to avoid hitting limits during critical moments.

Best Practices Summary

-

Scout before you copy. Build a curated list of wallets with proven track records, not just big volume.

-

Wait for consensus. Single whale trades are noise. Multiple whales converging on the same outcome is signal.

-

Paper trade first. Validate your strategy before risking real money.

-

Manage slippage. Use limit orders and accept that you cannot catch every move.

-

Respect rate limits. Plan your polling frequency around your API tier.

-

Never risk more than you can lose. Even the best copy trading strategy has losing streaks.

Conclusion

Copy trading on Polymarket is a viable strategy for traders who lack the time or resources to conduct deep research on every market. By identifying consistently profitable whales and waiting for consensus signals, you can piggyback on the work of smarter players.

But copy trading is not passive income. It requires ongoing effort to maintain your whale list, tune your filters, and manage risk. The traders who succeed are the ones who treat copy trading as one tool in a broader toolkit, not as a magic bullet.

If you are ready to take your Polymarket trading to the next level, PolyAlertHub's Elite Plan provides full API access, unlimited alerts, whale consensus data, and paper trading capabilities. Everything you need to build and test your own copy trading system.

Resources:

Frequently Asked Questions

Is copy trading on Polymarket legal?

Copy trading itself is not illegal. You are simply observing publicly available on-chain data and making your own trading decisions based on that information. However, prediction market regulations vary by jurisdiction. Users are responsible for ensuring they comply with local laws regarding prediction market participation.

How do I get an API key for PolyAlertHub?

API access is available through the Elite Plan. After subscribing, you can generate your API key from the API Keys page in your account settings. Keys are prefixed with poly_ and should be kept secure.

Can I use the API for commercial trading bots?

Yes, the API can be used for personal automated trading. If you intend to redistribute data or build commercial products on top of the API, please contact PolyAlertHub to discuss licensing arrangements.

How often should I poll the whale trades endpoint?

For most use cases, polling every 30 to 60 seconds provides a good balance between responsiveness and rate limit consumption. If you need faster updates, consider upgrading to the Heavy tier which offers higher rate limits.

What is the difference between whale alerts and whale consensus?

Whale alerts notify you when a single large trader makes a significant trade. Whale consensus identifies when multiple large traders have independently taken the same position on an outcome. Consensus signals are generally higher conviction.

Disclaimer: The content provided in this article and via the PolyAlertHub tools is for informational purposes only. It does not constitute financial, investment, or trading advice. Prediction markets carry high risk, and you should never wager more than you can afford to lose. Past performance of tracked wallets does not guarantee future results.