How to Paper Trade on Polymarket Using PolyAlertHub's Paper Trading Functionality

Are you curious about prediction markets but hesitant to risk real money? Polymarket paper trading through PolyAlertHub offers the perfect solution a risk-free environment where you can practice trading strategies, understand market dynamics, and build confidence before committing actual funds.

In this comprehensive guide, you'll learn how to paper trade prediction markets effectively using PolyAlertHub's powerful paper trading functionality. Whether you're a complete beginner or an intermediate trader looking to refine your strategies, this PolyAlertHub tutorial will walk you through everything you need to know about Polymarket simulated trading.

What is Polymarket?

Before diving into paper trading, let's understand the platform you'll be practicing on.

Polymarket is a decentralized prediction market platform where users can trade on the outcomes of real-world events. Unlike traditional betting, Polymarket operates on the principle that market prices reflect collective probability assessments. When you see a market priced at $0.65, it means the crowd believes there's approximately a 65% chance that outcome will occur.

Key Insight: Prediction markets are powerful tools for information aggregation. The prices aren't just bets they represent the collective wisdom of all market participants on the likelihood of future events.

How Polymarket Prices Work

Polymarket uses a binary outcome system where shares are priced between $0.00 and $1.00:

- $0.00 = The market believes this outcome has 0% chance of happening

- $1.00 = The market believes this outcome has 100% chance of happening

- $0.50 = The market is uncertain, pricing the outcome at 50/50

When an event resolves, winning shares pay out $1.00, while losing shares become worthless. This creates opportunities for traders who can accurately predict outcomes better than the market consensus.

What is Paper Trading and Why Does It Matter?

Paper trading (also known as simulated trading or virtual trading) is the practice of trading with virtual money in a simulated environment that mirrors real market conditions. Think of it as a flight simulator for traders you get all the experience without any of the risk.

Benefits of Paper Trading on Polymarket

- Zero Financial Risk – Learn without losing real money

- Strategy Testing – Experiment with different approaches to see what works

- Market Understanding – Grasp how prediction markets move and why

- Emotional Preparation – Experience the psychology of trading without real stakes

- Confidence Building – Develop skills before transitioning to live trading

Pro Tip: Even experienced traders use paper trading to test new strategies. It's not just for beginners it's a valuable tool for continuous improvement.

Overview of PolyAlertHub

PolyAlertHub is a comprehensive analytics and alert platform designed specifically for Polymarket traders. While many know it for its powerful alert system, PolyAlertHub also offers a robust paper trading functionality that seamlessly integrates with real-time market data.

Core Features of PolyAlertHub

PolyAlertHub provides several categories of alerts and tools to help you trade smarter:

- Price Alerts – Get notified when markets hit your target prices

- Trader Alerts – Follow and receive updates on specific traders' activities

- Whale Alerts – Track large position changes from major market participants

- Market Updates – Stay informed about new markets and significant developments

- Insider Alerts – Monitor positions from traders with potential insider knowledge

- Paper Trading – Practice your strategies in a simulated environment

Why Use PolyAlertHub for Paper Trading?

Unlike standalone paper trading platforms, PolyAlertHub's simulation is tightly integrated with its alert ecosystem. This means you can:

- React to Real Alerts – Practice responding to price triggers and whale movements

- Access Real Data – Trade with actual market prices and order books

- Track Performance – Monitor your simulated P&L with detailed analytics

- Build Discipline – Develop trading habits that transfer to real trading

Step-by-Step Guide to Paper Trade on Polymarket

Ready to start your Polymarket paper trading journey? Follow this comprehensive PolyAlertHub tutorial to get set up and trading in minutes.

Step 1: Create Your PolyAlertHub Account

First, you'll need to sign up for PolyAlertHub if you haven't already:

- Visit PolyAlertHub.com

- Click "Get Started" or "Sign Up"

- Create your account using email

- Verify your email address to activate your account

Note: Paper trading is available to all PolyAlertHub users. Premium features provide additional analytics and alert capabilities.

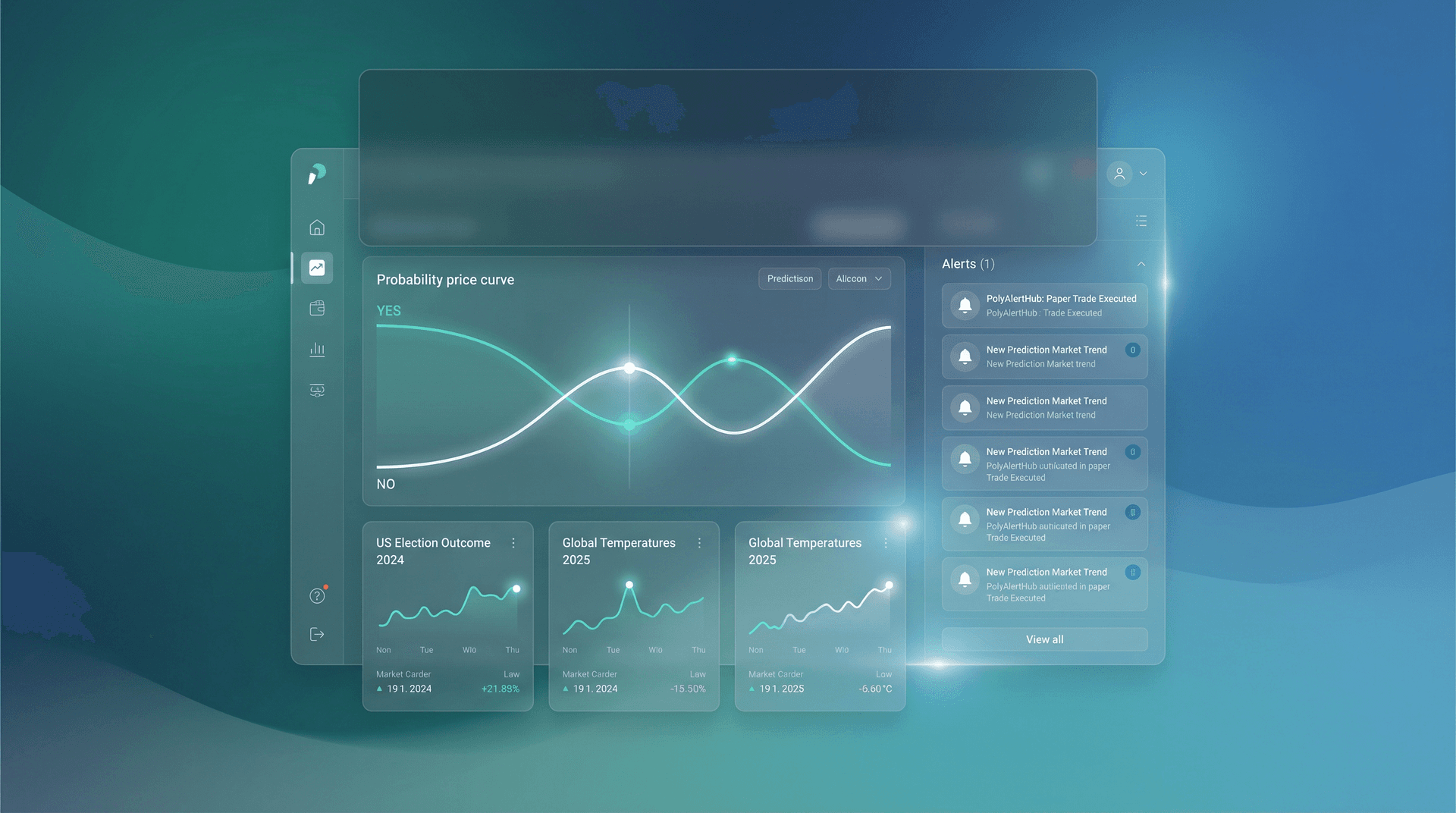

Step 2: Access the Paper Trading Dashboard

Once logged in, navigate to the Paper Trading section:

- Click on "Paper Trading" in the main navigation menu

- You'll see your virtual portfolio dashboard with starting capital

- Familiarize yourself with the interface it mirrors real trading closely

Your paper trading account comes pre-loaded with virtual funds, allowing you to start practicing immediately.

Step 3: Explore Available Markets

The Paper Trading interface displays all active Polymarket events:

- Browse markets by category (Politics, Crypto, Sports, Entertainment, etc.)

- Use the search function to find specific events

- Click on any market to view detailed information including:

- Current price/probability

- Order book depth

- Price history chart

- Trading volume

Step 4: Place Your First Simulated Trade

Now for the exciting part placing your first paper trade:

- Select a Market – Choose an event you want to trade

- Choose Your Side – Decide whether to buy "Yes" or "No" shares

- Set Your Amount – Enter how much virtual money you want to invest

- Review the Details – Check the estimated shares and potential payout

- Execute the Trade – Click "Buy" to place your simulated order

Your position will now appear in your Positions tab, where you can monitor its performance in real-time.

Leverage PolyAlertHub's alert system to practice informed trading:

- Create Price Alerts – Set triggers for when markets reach specific levels

- Follow Whale Activity – Monitor large traders' movements for signals

- Track Trader Alerts – Follow successful traders and learn from their patterns

When alerts fire, practice responding just as you would with real money this builds crucial muscle memory for actual trading.

Step 6: Monitor and Manage Your Positions

The Paper Trading dashboard provides comprehensive position management:

- Positions Tab – View all your current holdings with real-time P&L

- Open Orders Tab – See pending limit orders waiting to be filled

- Trade History Tab – Review all executed trades and outcomes

- Account Stats – Track overall performance metrics

Regular performance review is crucial for improvement:

- Check your win rate across different market types

- Analyze average profit/loss per trade

- Identify patterns in your successful vs. unsuccessful trades

- Review your timing on entries and exits

Examples and Best Practices

Market Selection Strategies

Different market categories offer unique opportunities and challenges:

Political Markets

- Often have longer time horizons

- Can experience sharp movements based on news events

- Require staying informed about political developments

Crypto Markets

- Higher volatility and faster resolution times

- Price movements can be dramatic

- Technical analysis may be useful

Sports Markets

- Clear resolution dates and outcomes

- Statistics and historical data readily available

- Good for practicing quick decision-making

Best Practices for Effective Paper Trading

Follow these guidelines to maximize your learning:

-

Treat It Like Real Money

- Take your paper trades seriously

- Don't make reckless bets just because it's simulated

- Practice the discipline you'll need for real trading

-

Keep a Trading Journal

- Document your reasoning for each trade

- Record market conditions when you entered/exited

- Note emotional states and how they affected decisions

-

Set Realistic Position Sizes

- Use position sizes that match what you'd actually trade

- Practice proper bankroll management

- Don't over-leverage just because it's virtual

-

Use Alerts Strategically

- Set price alerts at key levels

- Practice responding to whale movements

- Develop a systematic approach to alert-triggered trades

-

Review and Iterate

- Regularly analyze your performance

- Identify what's working and what isn't

- Continuously refine your strategy

Common Beginner Pitfalls to Avoid

Warning: These mistakes can sabotage your learning experience:

- Ignoring Paper Trading Results – Your simulated performance reveals real insights about your strategy

- Trading Without a Plan – Random trading teaches random lessons

- Overtrading – Quality over quantity applies even in simulation

- Not Respecting Stop Losses – Practice discipline with every trade

- Skipping Position Sizing – Proper sizing is crucial for real trading success

- Trading Based on FOMO – Fear of missing out leads to poor decisions

Advanced Paper Trading Techniques

Once you're comfortable with the basics, try these advanced strategies:

Alert-Based Trading System

Create a systematic approach using PolyAlertHub's alerts:

- Identify markets you want to track

- Set price alerts at key probability levels

- Define your entry and exit rules in advance

- Execute trades when alerts trigger (no second-guessing)

- Review results and refine your rules

Whale Following Strategy

Use Whale Alerts to practice following smart money:

- Enable Whale Alerts for your tracked markets

- Observe patterns in whale behavior

- Paper trade in the same direction as significant whale positions

- Track whether following whales improves your win rate

Multi-Market Portfolio Practice

Diversify your paper trading across multiple events:

- Allocate your virtual capital across different categories

- Practice portfolio balancing

- Learn how correlated events affect each other

- Develop a holistic market view

Transitioning from Paper to Real Trading

When you're ready to move from simulation to reality, follow these guidelines:

- Achieve Consistent Paper Profits – Ensure your strategy works over many trades

- Start Small – Begin with minimal real capital

- Maintain Your Discipline – Use the same rules that worked in paper trading

- Expect Emotional Differences – Real money trades differently; be prepared

- Keep Learning – Continue using paper trading to test new strategies

Start Your Paper Trading Journey Today!

Ready to practice your prediction market strategies risk-free? PolyAlertHub's paper trading feature gives you everything you need to build confidence and develop winning strategies.

Join thousands of traders who started their journey with paper trading.

Try Paper Trading Now →

Start with virtual funds immediately • Full access to real market data

Frequently Asked Questions

Is paper trading on PolyAlertHub completely free?

Yes, paper trading is available to all PolyAlertHub users. You can practice with virtual funds without any cost.

How much virtual money do I start with?

Paper trading accounts are pre-loaded with virtual funds, allowing you to place realistic position sizes and practice proper bankroll management.

Does paper trading use real market prices?

Absolutely. PolyAlertHub's paper trading uses real-time Polymarket data, so your simulated trades execute at actual market prices.

Can I reset my paper trading account?

Yes, you can reset your paper trading account at any time to start fresh with a clean slate and restored virtual balance.

How long should I paper trade before using real money?

There's no fixed timeline focus on achieving consistent profitability over at least 50-100 trades before considering real money. The goal is developing a proven, repeatable strategy.

Ready to take control of your trading education? Sign up for PolyAlertHub and start your paper trading journey today.